The International Monetary Fund (IMF) on Wednesday released the results of its 2024 Financial Access Survey (FAS), marking the survey’s 15th anniversary. The report, titled “FAS: 2024 Highlights,” revealed significant trends in global financial service accessibility, underscoring a notable shift towards digital offerings while traditional financial services face decline.

Covering 192 economies, the FAS is the leading annual database on financial inclusion, featuring 121 series and 70 normalized indicators. Since its inception in 2009, it has provided critical data that informs policies aimed at enhancing financial inclusion and advancing Sustainable Development Goals (SDGs).

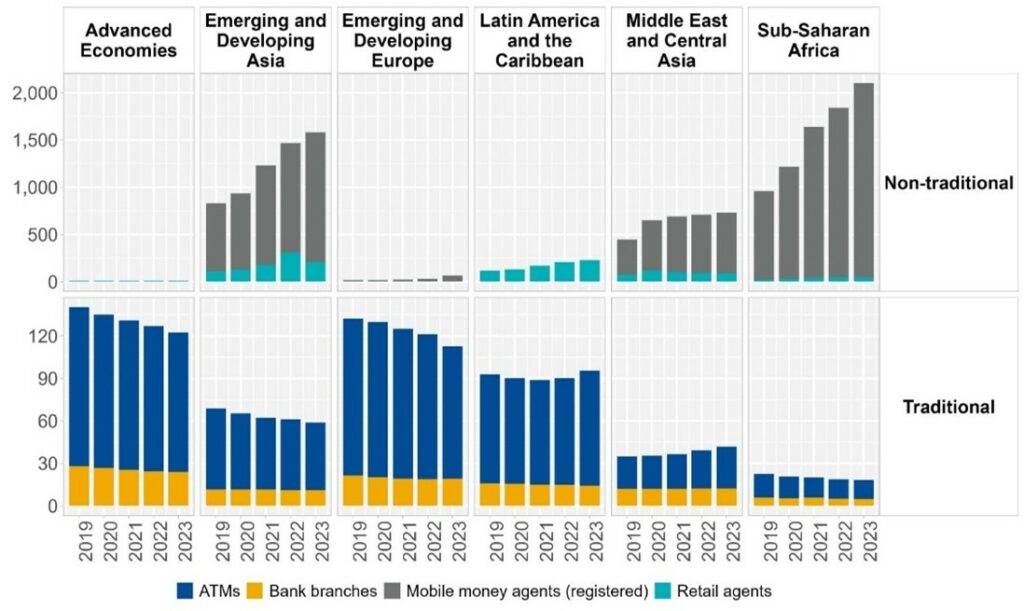

The report highlighted the growing prevalence of mobile and internet banking, particularly in Sub-Saharan Africa. While digital platforms have expanded access, traditional financial services, such as ATMs and bank branches, are seeing decreased usage, a trend accelerated by the COVID-19 pandemic. From 2013 to 2019, the number of deposit accounts per 100 adults surged by over 40 percent in emerging and developing Europe and Sub-Saharan Africa, showcasing the rising demand for alternative financial services.

Despite this progress, significant challenges remain, especially regarding gender disparities. Current data indicates that women hold only 64 percent of outstanding deposits compared to men and account for just 46 percent of outstanding loans. Notably, advanced economies show greater gender parity in financial inclusion than emerging markets, with regions like emerging and developing Europe and Latin America demonstrating relatively better gender equity.

Microfinance institutions (MFIs) have proven resilient, with an increase in borrowing among economically marginalized groups during recent economic downturns. MFIs now outpace commercial banks in terms of client base served, although commercial banks typically offer larger loans.

However, lending to small and medium-sized enterprises (SMEs) has declined, with outstanding SME loans decreasing between 2021 and 2023 due to tightening financial conditions and geopolitical tensions, despite supportive measures enacted during the pandemic.

To better serve policymakers, the IMF is launching a pilot initiative to enhance the FAS data. This project will introduce additional gender disaggregation and incorporate emerging fintech services, as well as critical factors such as loan pricing and risks faced by underserved populations, ensuring the data remains relevant for informing financial inclusion strategies.

As the financial landscape evolves, the IMF stressed the importance of adapting strategies to promote equitable growth and reduce global inequalities.