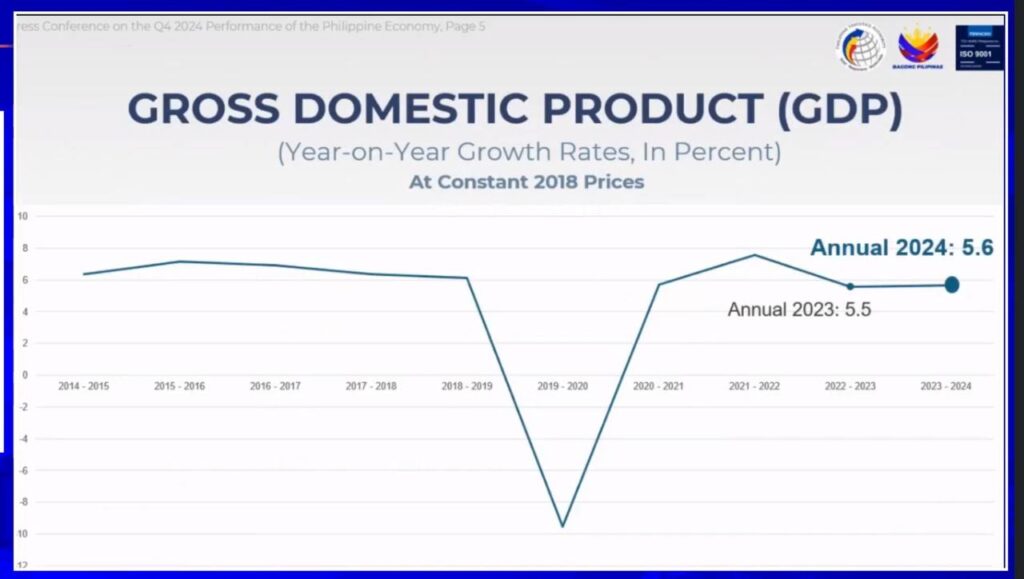

The Philippine economy showed resilience in 2024, posting a 5.6 percent year-on-year growth in gross domestic product (GDP), despite challenges such as the contraction in agriculture due to El Niño and a series of storms. However, this growth fell short of the government’s target of between 6.0 percent and 6.5 percent.

“We faced numerous setbacks in 2024, including extreme weather events, geopolitical tensions, and subdued global demand, similar to the challenges we encountered in 2023,” said Economic Planning Secretary Arsenio Balisacan in a statement delivered by Undersecretary Rosemarie Edillon on Thursday.

“This suggests that these conditions may represent the new normal. While some challenges affect the entire economy, others place pressure on specific sectors. Our economic performance in 2024 depended on how these factors impacted various sectors and whether we could mitigate their negative effects or facilitate a swift recovery. In a word, it is about resilience. Therefore, beyond aiming for higher growth, our focus is on building resilience,” Balisacan said.

According to the Philippine Statistics Authority, the GDP growth for the fourth quarter alone was 5.2 percent, driven primarily by strong performances in wholesale and retail trade, financial services, and construction. Wholesale and retail trade grew by 5.5 percent, financial and insurance activities expanded by 8.5 percent, and construction surged by 7.8 percent.

For the full year, the industries that contributed most to GDP growth were similar, with construction leading at 10.3 percent, followed by financial services at 9.0 percent, and wholesale and retail trade at 5.6 percent. The services and industry sectors also posted steady growth, increasing by 6.7 percent and 5.6 percent, respectively, in 2024.

However, the agriculture, forestry, and fishing (AFF) sector contracted by 1.6 percent for the year, continuing its decline in the fourth quarter with a 1.8 percent drop.

On the demand side, Household Final Consumption Expenditure (HFCE) grew by 4.7 percent in Q4, while government spending (GFCE) and gross capital formation also posted strong gains. Additionally, the country’s Gross National Income (GNI) rose by 6.2 percent in Q4, bringing full-year growth to 7.6 percent. Net Primary Income from abroad saw an impressive 26.1 percent rise in 2024, signaling robust external financial inflows.

Balisacan highlighted that it is clear the key to economic growth in the “new normal” is building resilience and ensuring adaptability to changing preferences. “We just presented the draft Philippine Development Report (PDR) 2024 to the President and the Cabinet last week. In the PDR, we take stock of our accomplishments, compare these against the Philippine Development Plan (PDP) targets, and, more importantly, identify the lessons learned and how we move forward to attain our development targets,” he said.

The PDR 2024 underscored the government’s failure to meet targets for economic growth, quality employment, and food inflation. It noted that while the Philippines still emerged as one of the fastest-growing economies in the region, behind only Vietnam and China, growth fell short of the 6.0 to 6.5 percent target for the year. It added that while target employment numbers were achieved, the quality of jobs left much to be desired. Although food inflation started easing late in 2024, it still posed a significant challenge for the economy.

“To achieve resilient economic growth, we need to diversify our sources of growth. For inclusive, quality employment, we must encourage more investments in sectors that require workers with higher-level skills and further develop an agile workforce. To keep food inflation low and stable, we need to anticipate potential shocks and continue to employ multi-pronged approaches,” Balisacan concluded.

Financial analyst Jonathan Ravelas, managing director of eManagement for Business and Marketing Services, called the GDP performance “quite disappointing,” noting that 2024 marked the second consecutive year the country failed to reach growth above 6.0 percent. He cautioned that the weaker-than-expected economic performance could weigh on the Philippine stock market, potentially pushing its main index toward the 5,000 level.

At noon on Thursday, the Philippine Stock Exchange Index was down 0.3 percent to 6,134.75.