Metro Retail Stores Group Inc. (MRSGI), the Gaisano family’s retail arm, reported a slight 1 percent decline in net income to ₱609.42 million in 2024 from ₱618.02 million a year earlier, as rising sales were tempered by tighter margins and strategic shifts in business mix.

Despite the profit dip, MRSGI posted a 3 percent year-on-year increase in revenue to ₱39.62 billion, driven by contributions from new store openings and a 5 percent boost in its food retail segment. Same-store sales, however, rose by just 0.5 percent, with the company citing a deliberate reduction in low-margin wholesale transactions.

“In 2024, MRSGI showed its capability to achieve balanced growth,” said president and COO Manuel Alberto. “We expanded our network and increased net sales while maintaining a focus on operational efficiency.”

The company’s gross margin slightly narrowed to 21.4 percent from 21.6 percent in 2023, mainly due to earlier liquidation of aging inventory and a greater share of food retail in the sales mix. Still, MRSGI maintained its operating expense-to-sales ratio at 19 percent, crediting continued cost control measures and wider adoption of solar panels in store locations.

MRSGI expanded aggressively last year, opening eight new stores across Samar, Negros, and Cebu—bringing its total network to 71 branches. The company also launched a three-hectare Metro Distribution Center in Sta. Rosa, Laguna, equipped with modern logistics infrastructure designed to support scalable growth.

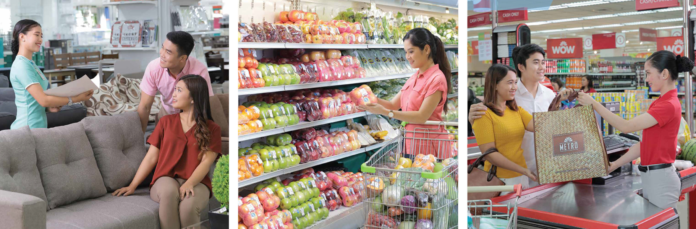

In line with its strategy of format diversification, MRSGI introduced its Metro Home Improvement and Lifestyle stores in Angeles, Pampanga; Hinigaran, Negros Occidental; and Catbalogan, Samar, broadening its portfolio beyond traditional supermarket and department store formats.

As part of its capital return strategy, MRSGI declared regular cash dividends totaling ₱194.54 million or ₱0.06 per share.

The company’s performance highlights a continued push toward long-term growth through regional expansion and operational discipline, despite near-term margin pressures.