The country’s status as one who borrows from rather than lends to neighbors on the global stage improved substantially in the second quarter of 2022.

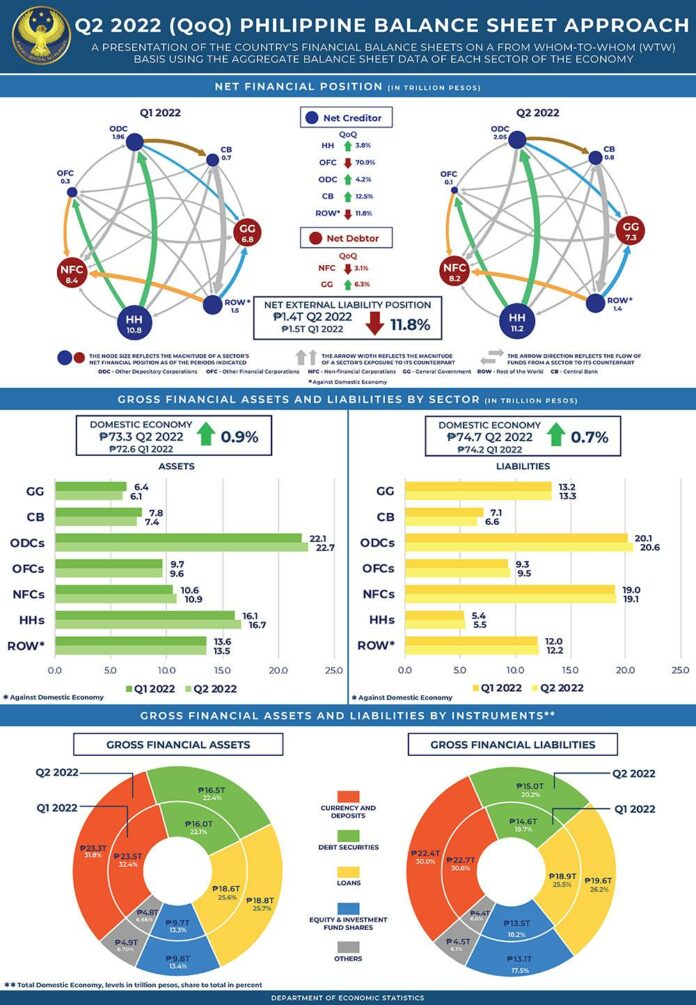

The Bangko Sentral ng Pilipinas (BSP) reported that the country’s net external liability position, or the gap between its foreign assets versus its foreign obligations, narrowed by 11.8 percent to the local currency equivalent of only P1.4 trillion.

The improvement was traced to the lower net external liabilities of the so-called non-financial corporations (NFC) whose net liabilities barely changed at P19.1 trillion from P19 trillion even as its net assets rose to P10.9 trillion versus P10.6 trillion a quarter earlier.

On the aggregate, the gross financial assets of all sectors expanded by 0.9 percent to P73.3 trillion from P72.6 trillion even as their gross financial liabilities similarly increased but a lower pace of 0.7 percent to P74.7 trillion from P74.2 trillion.

Apart from the NFCs, the various sectors include the general government (GG), central bank (CB), other depository corporations (ODC), other financial corporations (OFC), households (HH) and finally the rest of the world (ROW).

According to the BSP, the NFCs, which include insurance companies, venture capital firms, currency exchanges, pawnshops and the like, was one of two net debtor sectors that include the general government.

The gross financial assets of the general government (GGs) improved to P6.4 trillion in the second quarter from only P6.1 trillion in the first quarter but their gross financial liabilities stood way larger and barely improved to P13.2 trillion from P13.3 trillion during the period.

As a result, both the GG and the NFCs were in the net debtor list during the period.

The net creditor list include households with gross assets worth P16.1 trillion versus gross liabilities of only P5.4 trillion, other financial corporation assets of P9.7 trillion versus P9.3 trillion, other depository corporation assets worth P22.1 trillion versus liabilities of P20.1 trillion, the central bank with assets of P7.8 trillion and liabilities of only P7.1 trillion and the so-called rest of the world with aggregate assets of P13.6 trillion and liabilities of P12 trillion.

As indicator of a country’s capacity to incur debt from overseas sources and pay as these fall due, show that the latest numbers as sustainable, the BSP said.

But even then, the numbers show a reversal from when the Philippines and its managers who kept to the prudent side of fiscal and monetary operations, stood as a net creditor state or one that lends rather than borrows from its neighbors under then President Joseph Estrada.

Estrada was beneficiary to the structural and policy reforms adopted by earlier administrations that began with President Corazon Aquino.