FundSpace, a loan aggregator under Globe’s 917Ventures, has teamed up with Esquire Financing, Inc., a leading non-collateral business loan provider, to provide financing solutions for small and medium-sized enterprises (SMEs).

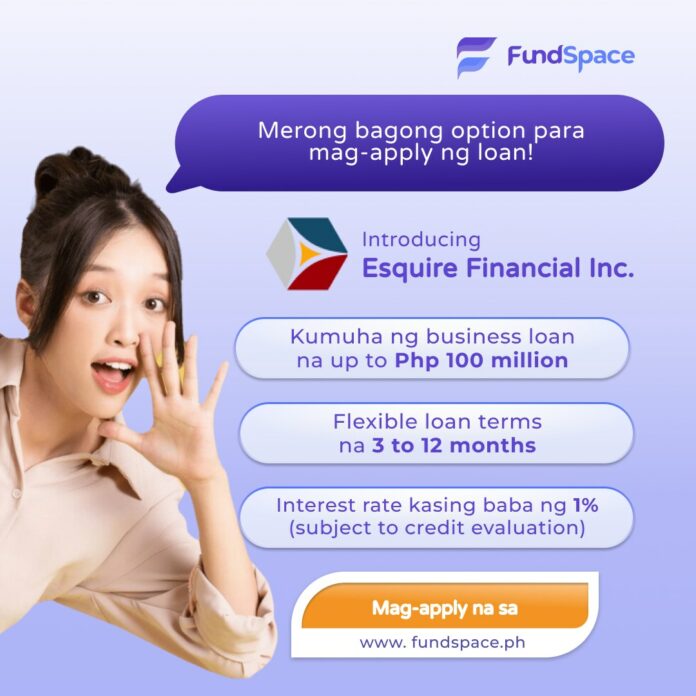

With the integration of Esquire Financing into its platform, FundSpace makes available some of the most substantial loan funds available for SMEs, ranging from P50,000 to as big as P100 million.

These loans come with attractive interest rates between 1.5 percent and 3.5 percent, and flexible terms of 3 to 12 months. Processing time is also 12 times faster than traditional methods while the disbursement is eight times quicker.

“With our newest partner Esquire Financing Inc., FundSpace continues to offer additional and flexible loan options, empowering SMEs in the Philippines to realize their full potential,” said Martin Luchangco, entrepreneur-in-residence at 917Ventures.

“Our platform’s competitive interest rates and efficient application process ensure local businesses have a more accessible avenue to secure funding,” he added.

Alisa Bermudez, venture builder for FundSpace at 917Ventures, said the company provides local entrepreneurs with a swift, user-friendly, and accessible financial resource. “We envision this platform as a springboard for enterprises of all sizes to seize greater opportunities, with financial support now easily attainable.”

FundSpace collaborates with reputable financing institutions, offering a diverse range of financing options designed to meet the unique needs of every enterprise. The company’s overarching mission is to bolster SME operations by providing access to capital through its multiple core products.

One of FundSpace’s standout feature is its streamlined loan application process. Prospective borrowers can effortlessly select their preferred loan amount and financier and easily receive assistance.

To be eligible for a loan, applicants must be Filipino citizens residing in the Philippines and have businesses registered with the Department of Trade and Industry (DTI) and the local government unit covering their location. They should be aged between 21 and 70 years at the time of loan maturity and have at least 1 year of business operation.