New acquisitions and better-than-industry occupancy rate drove net income of AREIT Inc. in the first quarter 45 percent higher to P1.47 billion, excluding the net fair value change in investment properties.

AREIT, the real estate investment trust of the Ayala Group, saw total revenue in the January-March quarter also 43 percent higher to P2.11 billion.

The strong performance in the first quarter allowed AREIT’s board to approve the declaration of P0.56 per share cash dividend for the first quarter, equivalent to around 90 percent of net profit, or a total P1.33 billion–the highest since its initial public offering in 2020.

Dividends have doubled since AREIT’s inception on account of strong performance of existing properties and constant addition of new and larger assets. The cash dividends will be payable on June 13 to shareholders on record May 28.

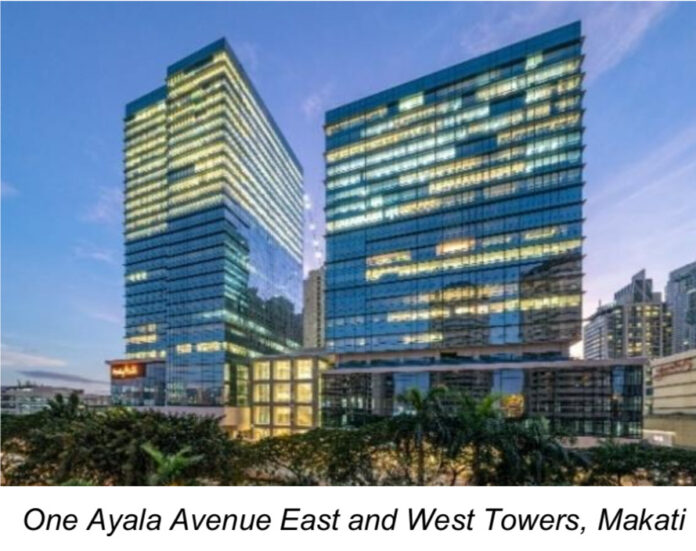

AREIT said its acquisition of new One Ayala Avenue East and West Office Towers, Glorietta 1 and 2 Mall and Office buildings at Ayala Center Makati, MarQuee Mall in Pampanga and the Seda Hotel in Lio, El Nido were the primary drivers of earnings in the first quarter.

The new properties increased the assets under its management to P88.6 billion during the quarter and the occupancy rate to 96 percent.

The listed REIT should see a further boost in earning after it signed in March a deal with Ayala Land, Inc. and its subsidiaries Greenhaven Property Ventures, Inc. and Cebu Insular Hotel Co., Inc., and Buendia Christiana Holdings Corp., for the acquisition of several properties worth P28.6 billion in exchange for 841.3 million valued at P34 each. The deal will lift the value of Assets Under Management to P117 billion, four times larger than it was during the IPO.

The assets include Ayala Triangle Gardens Tower Two, Greenbelt 3 and 5, Holiday Inn in Ayala Center Makati and Seda Ayala Center Cebu, as well as the 276-hectare land in Zambales for solar power plant operations.