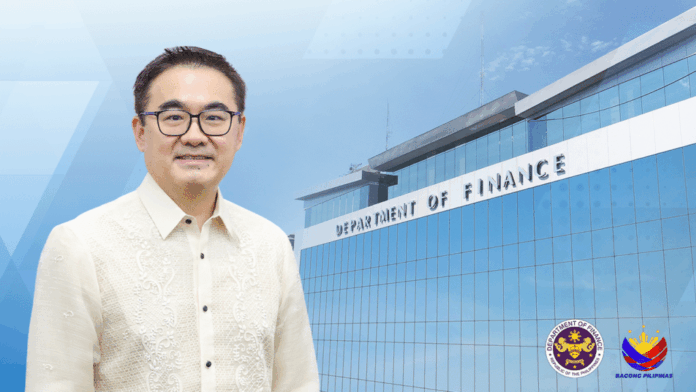

The Bureau of Internal Revenue (BIR), under the direct supervision of newly minted Finance Secretary Frederick D. Go, on Monday announced the immediate and temporary suspension of all field audits and related operations, including the issuance of Letters of Authority (LOAs) and Mission Orders (MOs), following widespread taxpayer concerns over audit practices.

BIR Commissioner Charlito Mendoza said the suspension aims to protect taxpayer rights, prevent potential misuse of authority, and restore public trust in the agency. “We hear the people. We hear your concerns and are immediately acting on them,” Mendoza said, pledging that audits will be conducted with professionalism, fairness, and full adherence to the law.

The suspension affects all BIR audit units, including the Large Taxpayers Service, Revenue Regions and District Offices, VAT Audit Units, and Intelligence and Special Audit Units. Exceptions are limited to urgent or legally mandated cases such as criminal investigations, refund audits, or time-sensitive transactions.

The move carries significant policy implications for taxpayers in the country. Many have long reported harassment, unclear procedures, and inconsistent enforcement during audits. The suspension signals a stronger commitment to taxpayer protection and a move toward more transparent and predictable audit processes. The BIR has created a Technical Working Group tasked with reviewing existing procedures, improving LOA protocols, and integrating digital safeguards to ensure audits are evidence-based, fair, and consistent. At the same time, the agency is reviewing internal protocols to prevent irregularities, misuse of authority, and favoritism, aiming to strengthen both accountability and efficiency.

For businesses, the temporary suspension may provide relief from sudden inspections, though it could also create short-term uncertainty for ongoing audits or large transactions.

Commissioner Mendoza stressed that the reform measures align with President Ferdinand Marcos Jr.’s directive to maintain fair, predictable, and efficient revenue collection while improving service for workers, small business owners, and all taxpayers reliant on transparent audit processes.

“This is a step toward audits that are predictable, technology-driven, and fair—protecting taxpayers while strengthening the integrity of the BIR,” Mendoza said.

Earlier, the BIR reported having collected the bulk, or 69 percent (P2.32 trillion) of aggregate revenues of P3.36 trillion in only nine months this year.

The agency, now under new leadership, had been tasked to collect at least P3.22 trillion this year.