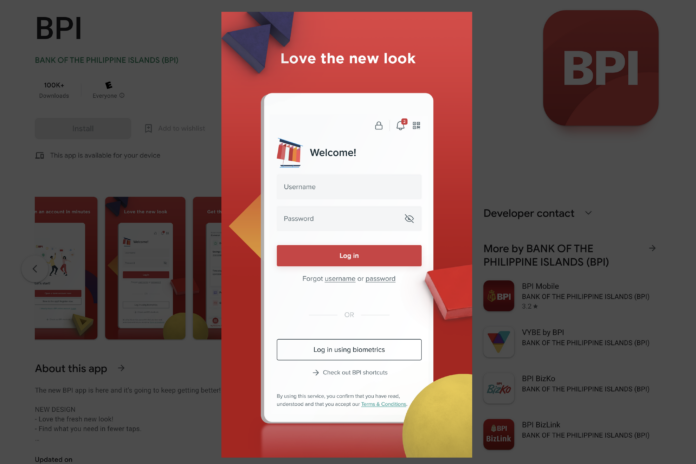

Ayala-led Bank of the Philippine Islands (BPI) launched a totally new and future-ready mobile app with innovative features and services that go beyond convenient transactions and help more Filipinos work their way towards financial well being.

This reinforces the bank’s solid footing as a digital banking leader in the country.

BPI President and CEO Jose Teodoro “TG” Limcaoco said that the 171-year old bank continues with its aggressive digital transformation journey.

“We’re proud of the new BPI app, and we know there’s room to continue improving. While we look at the best technology and digital solutions to ensure that we deliver excellent service, we anchor the designed experiences to what our customers need,” Limcaoco said.

BPI consumer banking head Maria Cristina “Ginbee” Go said that the new BPI app is key to the bank’s “phygital” approach to make the bank accessible to more Filipinos through physical branches, and digital channels and platforms.

“Our customers have the option to bank with the app in tandem with BPI branches and ATMs—giving them a choice of their preferred channel with integrated services like online booking of branch visits or cashless withdrawal,” Go said.

BPI Consumer Bank Marketing, Platforms, and Digital Activation Head Mariana Zobel de Ayala emphasized that the new app goes beyond everyday transactions and helps build towards Filipinos’ financial independence.

“This boasts of a new design and experience, and we look forward to exciting new features that you won’t find in the older BPI Mobile app like mobile check deposit, AI-powered insights on your savings and spending, and more. These are core retail products designed not just to be convenient and sustainable but also customer-centric even in the long-term,” Zobel said.

The features of the new BPI app include improved user experience, online account opening, and personal finance management.

Other exciting features that are coming soon are mobile check deposit, real-time bill payment, cash withdrawal via QR, save favorite transactions, and more product applications.

BPI Consumer Platforms Head Fitzgerald Chee pointed out that BPI Mobile app users do not have to delete their old app yet.

“You can continue to log in the older BPI Mobile app with your current username and password. Users that want to start enjoying the new BPI app can find easy-to-follow guides on our Facebook and YouTube channels,” Chee said.

Chee also explained that QR codes generated on the older BPI Mobile app are still going to work on the new BPI app.

“You can also view all your personalized settings, previous transactions, and statements right away on the new BPI app. For your security, the Mobile Key works within the new BPI app or the older BPI Mobile app. Users can choose which app version to activate their Mobile Key,” Chee added.

All these form part of the bank’s goal to further enable high-quality customer experiences in line with one of its core values to be a customer-centric organization.