Foreign direct investments (FDI), the kind that stays for the long haul and generate jobs for Filipinos, fell 14.1 percent in April to only $876 million from $1.02 billion, the Bangko Sentral ng Pilipinas (BSP) said on Monday.

The bulk of those who left were invested in locally issued debt instruments collectively worth $663 million and left a void 7.7 percent wider than a year ago on concerns of slowing economic growth and high inflation.

The economy grew 6.4 percent in the first three months this year, sharply down from year-ago expansion averaging 8 percent as cost pressures mount across the Philippines and interest charges or the cost of money went north.

“The decline in FDI may be attributed to concerns over slowing economic growth and relatively high inflation levels globally,” the BSP said.

Equity investments which were channeled primarily in manufacturing, real estate, and the financial and insurance industries by Japanese, American and Singaporean investors during the month, posted the highest decline of 33.8 percent to $136 million.

FDIs gain preferential treatment from government as they not only generate jobs but contribute to the national coffers with the tax on their activities.

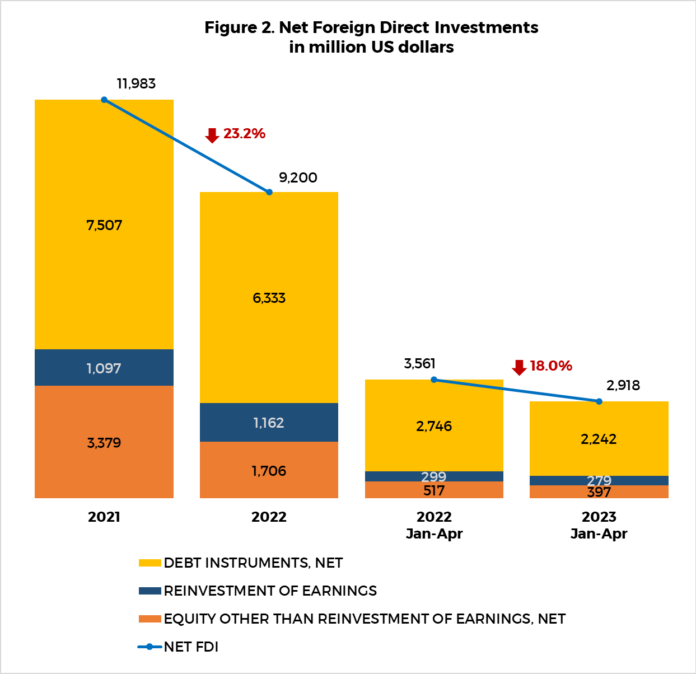

The three-month FDI similarly fell 18 percent this year to only $2.918 billion versus the year ago level of $3.561 billion the bulk of which were in debt instruments aggregating $2.242 billion from last year’s $2.746 billion.

Those foreign investors that actually placed money as equity in their Philippine enterprise also invested only $397 million in those three months or 23.2 percent lower than last year’s $517 million.

Even those who opted to reinvest their earnings from their Philippine exposure likewise weakened to only $397 million from last year’s $517 million, the BSP said.