The renewable energy arm of Manila Electric Co., better known as Meralco, said Thursday it is taking control of listed SP New Energy Corp. for an investment of P15.9 billion.

SPNEC will raise its authorized capital stock to 75 billion shares from 50 billion shares to create new stock that will be issued to MGen Renewable Energy Inc., which will be issued 15.7 billion common shares and 19.4 billion redeemable preferred voting shares. In all, MGreen will get total voting interest of 50.5 percent, giving it majority control.

The deal is still subject to regulatory approval, especially since MGreen is taking control of listed renewable energy firm SPNEC. As matters stand, the transaction may require MGreen to make a tender for SPNEC stocks held by minority shareholders.

SPNEC will use the fresh capital from MGreen to fund the construction and expansion of solar projects.

MGreen has agreed with SPNEC’s parent company, Solar Philippines Power Project Holdings Inc, to use the listed renewable energy firm SPH as the primary vehicle to develop 3,500 megaWatts of solar panels and 4,000 megaWatt-hours of battery energy storage systems in Luzon.

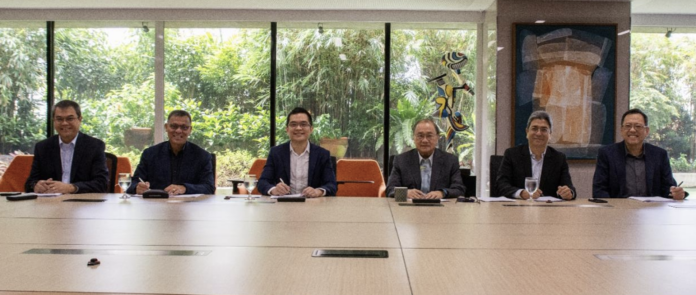

“This will be one of the largest solar projects not just in Asia, but in the world,” said Manuel V. Pangilinan, chairman and CEO of Meralco. “The Department of Energy’s vision is to have about 35 percent of the country’s energy come from renewable energy, and this is one of Meralco’s major contributions to this goal.”

“We are humbled and grateful for this opportunity to build this renewable energy platform with Meralco. We look forward to bring together Meralco’s capabilities and our solar developments for the benefit of all stakeholders,” said Leandro Leviste, CEO of SPNEC.

Transaction completion is subject to the satisfaction of certain conditions precedent, including the relevant regulatory approvals.

UBS acted as financial advisor in this transaction. SyCip Salazar Hernandez and Gatmaitan and Gulapa Law acted as legal advisors to both Meralco and MGreen. King & Spalding and Picazo Law acted as legal advisors to SPH and SPNEC.