Universal Robina Corp. (URC) reported consolidated sales of P45.3 billion for the first quarter ending 31 March 2025, up 7 percent year-on-year, as it delivered strong volume-led growth across most of its business divisions. The performance marks a robust start to the fiscal year, underscoring its commercial resilience and strategic focus on branded consumer products.

Operating income reached P5.5 billion, a modest 1 percent increase in line with expectations, while core net income rose 4 percent to P4.1 billion, aided by lower financing costs. However, net income from continuing operations declined 2 percent to P4.3 billion, largely due to elevated foreign exchange gains recorded in the same quarter last year.

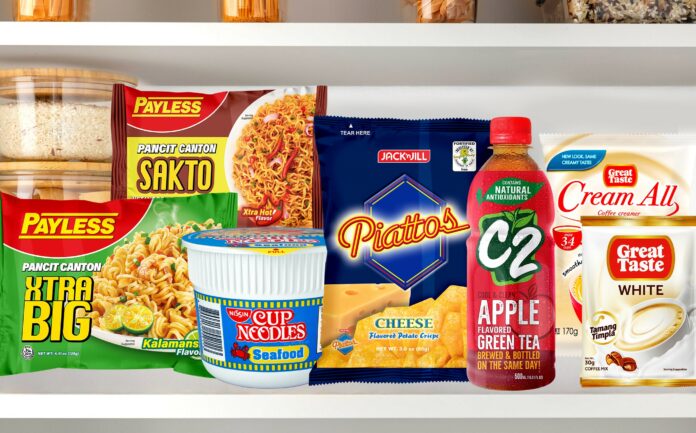

URC’s flagship Branded Consumer Foods (BCF) business posted P29.7 billion in sales, a 6 percent increase from a year earlier. Domestic operations contributed P20.1 billion, buoyed by double-digit volume growth in ready-to-drink beverages, snacks, and confectionery. International BCF sales rose 10 percent to P9.6 billion, with Vietnam leading gains and steady improvements seen in Malaysia and Indonesia, despite regional economic headwinds.

Meanwhile, Agro-Industrial and Commodities (AIC) sales climbed 8 percent to P15.6 billion, as strong demand in sugar and flour segments offset weaker performance in the animal feed business, which faced pressure from declining hog populations in the Philippines.

URC president and CEO Irwin Lee highlighted the company’s strategic progress, saying, “We are starting the year on a high note, delivering impressive volume growth across our key branded businesses. As consumer sentiment improves, we’re poised to accelerate URC’s momentum and continue offering innovative products at competitive prices.”

The results reflect URC’s commercial agility and growth potential, particularly in its branded segment, as it navigates evolving market dynamics across Southeast Asia.