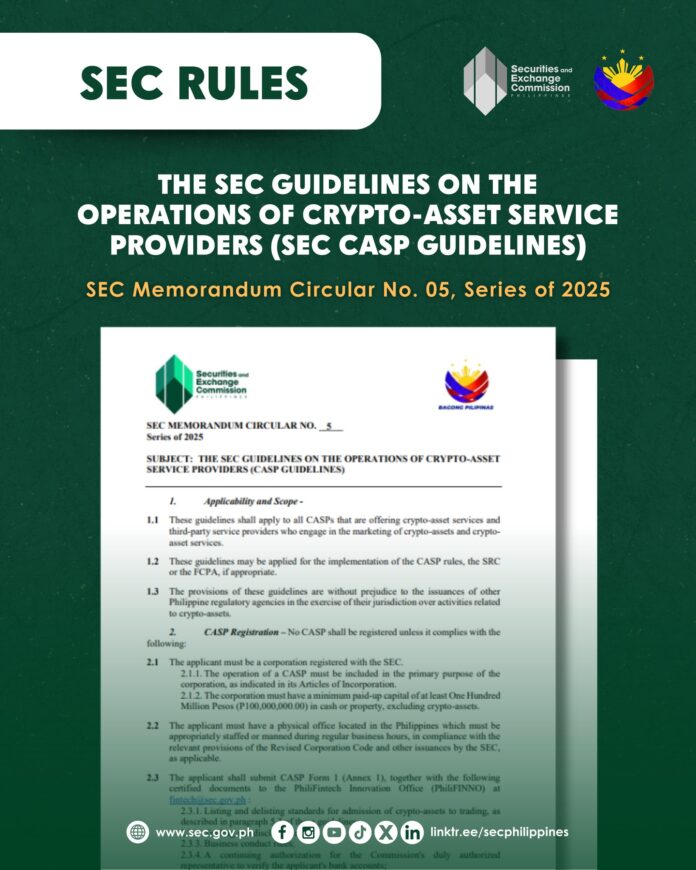

The Securities and Exchange Commission (SEC) has released the long-awaited rules and guidelines governing crypto asset service providers (CASPs), marking a significant step in regulating digital assets and their related services in the country.

Issued at the end of May, the new regulations aim to register and oversee all CASPs operating in the Philippines, requiring them to adhere to standards on registration, disclosure, and operations. The SEC defines a “crypto-asset” as a cryptographically secured digital representation of value or rights that can be transferred, stored, or traded electronically. If offered as investments, these may qualify as “crypto-asset securities” under the Securities Regulation Code (SRC).

A CASP is broadly defined to include entities that operate digital platforms offering crypto services. The rules extend to third-party marketers of crypto-assets, with stringent licensing and disclosure requirements. Entities marketing or offering such services must be duly registered corporations with the SEC and other regulators such as the Bangko Sentral ng Pilipinas.

Under the new framework, CASPs must have at least ₱100 million in paid-up capital (excluding crypto-assets), a staffed physical office, and comply with extensive operational reporting, including user and trade data. Registration applications cost ₱50,000, with annual supervision fees based on gross revenue.

Marketing and inducement activities are prohibited without proper licensing. Disclosure documents detailing issuers, risks, technology, and other key data must be published at least 30 days before any public offering. Educational content, if non-promotional and made in good faith, is exempt from marketing restrictions.