E-wallet giant GCash said the Bangko Sentral ng Pilipinas’ (BSP) regulatory directive to sever links with online gambling platforms has had no material impact on its revenue flow, citing the company’s diversified income streams.

Carl Raymond R. Cruz, president and CEO of Globe Telecom Inc., GCash’s parent company, said the e-wallet’s business is “highly diversified” and not reliant on the online gambling segment. While Cruz did not disclose how much of GCash’s revenue had been derived from such linkages, he assured stakeholders the company’s growth trajectory remains intact.

“Despite the regulatory requirement to delink, the growth story of GCash will definitely continue,” Cruz said.

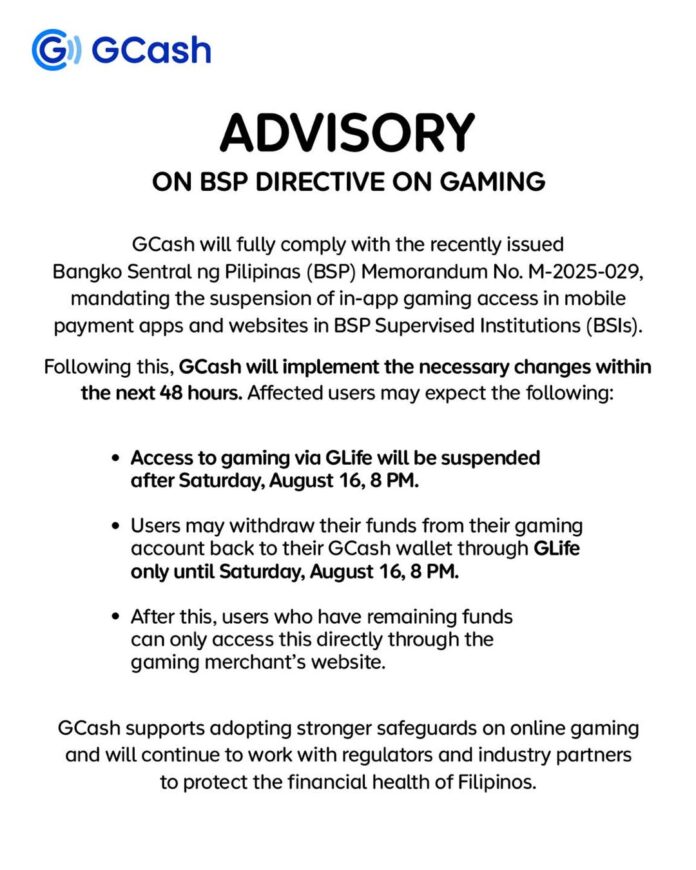

The BSP has mandated e-wallet operators to remove icons and links connecting payment platforms to online gambling sites, part of a broader effort to curb illegal betting activity.

From a commercial perspective, GCash’s position underscores its strategic resilience amid tighter regulations, while reinforcing the company’s positioning ahead of a potential initial public offering (IPO). Though no formal IPO application has been submitted to the Philippine Stock Exchange, Cruz said the organization continues to prepare for its “next phase of growth.”

GCash is operated by Mynt (Globe Fintech Innovations Inc.), a joint venture among Globe Telecom, Ayala Corp., and Ant Financial, an affiliate of China’s Alibaba Group. Mynt also runs Fuse Lending, catering to micro and small enterprises.

In June, Mynt’s board approved a stock split, slashing the par value of its common shares from ₱1 to ₱0.03. This move will increase the number of authorized shares from 2.14 billion to 71.65 billion, while maintaining the ₱2.14 billion authorized capital stock. The move is pending Securities and Exchange Commission (SEC) approval.