Maya, the country’s leading digital bank, is helping reshape how Filipinos access and use credit, with a flexible, real-life approach designed to empower both individual users and fuel commercial and corporate engagement.

Rather than a one-size-fits-all financial model, Maya’s credit system adapts to diverse life situations—from sudden emergencies to long-term goals—giving users greater control, transparency, and financial freedom. This user-centric innovation strengthens Maya’s positioning not just as a consumer bank but as a key digital financial player in the business ecosystem.

Key features of Maya’s dynamic credit suite include:

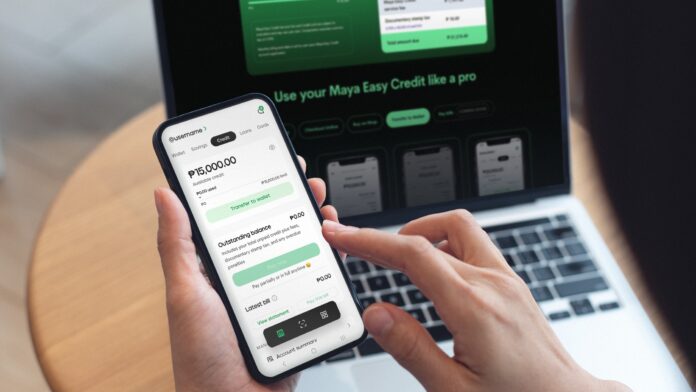

- Easy Credit: A revolving line of up to ₱30,000, instantly accessible via the Maya app, with no paperwork and up to 30 days to repay—ideal for on-the-go financial needs.

- Maya Personal Loan: Offering up to ₱250,000 with terms of up to 24 months and no collateral, supporting major life expenses or debt consolidation.

- Credit Cards with Built-In Rewards: Including the Landers Cashback Everywhere Credit Card (up to 5 percent cashback), and the Maya Black Credit Card, which earns flexible Maya Miles that can soon be converted to airline miles or used for shopping and dining.

- Integrated Savings Goals: Users can set up to five savings targets with 4 percent p.a. interest, encouraging disciplined financial planning while using credit tools.

Maya’s tailored approach supports both financial inclusion and smarter borrowing, aligning with its broader digital strategy to expand into commercial and enterprise-level services. The company’s focus on customized, app-integrated tools ensures borrowers remain financially agile while building long-term credit strength.

Regulated by the Bangko Sentral ng Pilipinas and insured by the PDIC, Maya’s innovative model underscores its commitment to responsible, accessible, and growth-oriented financial solutions.