Maya, the country’s leading fintech ecosystem and top digital bank, has launched the Maya Black Credit Card, a groundbreaking product that redefines credit card security in the Philippines by putting control directly in the hands of customers.

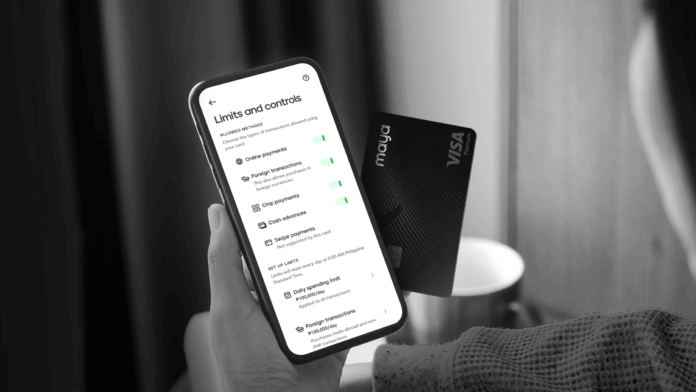

Unlike traditional hotline-reliant systems, Maya’s numberless credit card features an auto-refreshing CVV, an in-app Security Center for real-time blocking and limit-setting, and biometric and AI-powered fraud monitoring—all managed seamlessly through the Maya app.

“This is the future of secure finance: visible, real-time, and customer-driven,” said Shailesh Baidwan, Maya group president and Maya Bank co-founder. “When people know they are in control, they are more confident to use credit and grow with it.”

Maya’s innovation sets a new benchmark in Philippine banking, where card security has typically been handled reactively via customer service hotlines. By turning security into an intuitive, user-facing experience, Maya aims to encourage more Filipinos—only 15 percent of whom had credit cards as of 2024 (TransUnion Philippines)—to enter the formal financial system.

The launch supports Maya’s broader vision of “elevated finance,” where every financial product balances simplicity with robust protection. By integrating enterprise-grade defenses with real-time user controls, Maya positions itself at the forefront of financial inclusion and trust-building in the digital age.