As holiday shopping ramps up, BPI is reminding customers to stay vigilant against scams, which are becoming increasingly sophisticated. Fraudsters are now able to mimic official bank communications convincingly, whether through phone calls, text messages, or social media.

Jon Paz, BPI’s data protection officer, explained that most scammers don’t break into accounts by force. Instead, they manipulate people with urgency, fear, or familiarity to give away passwords, one-time passwords (OTPs), or other sensitive information. While banks continue to invest in cybersecurity tools like AI-driven monitoring and multi-factor authentication, human awareness remains the most important defense.

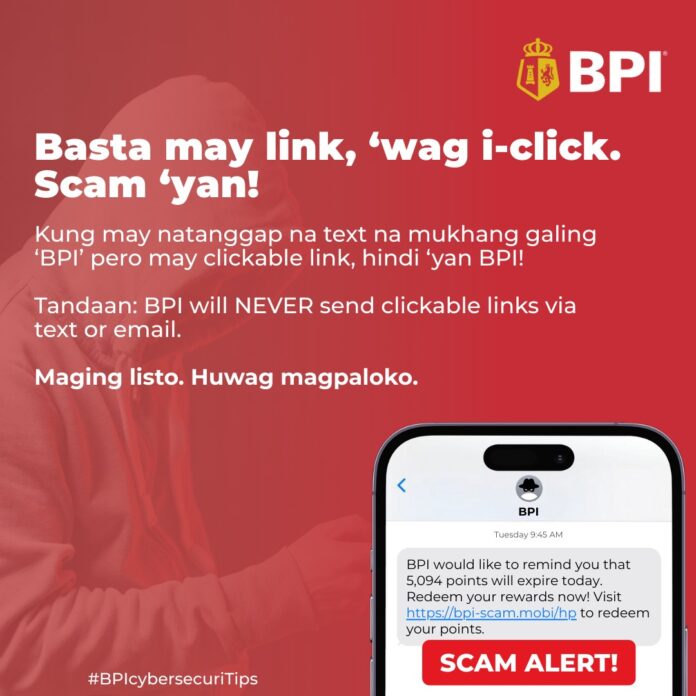

BPI highlighted several common scam tactics. Fake calls from people claiming to be bank staff often request OTPs or account details, but the bank never asks for these over the phone. Messages with links to look-alike websites promise rewards or refunds but are designed to steal login information; BPI never sends clickable links via email or text. Scammers may also pose as staff conducting “account verification” or request app downloads, but official apps should only be downloaded from recognized app stores.

Social media scams are also rising, with fraudsters sending fake payment confirmations or urgent requests for money, sometimes pretending to be friends or relatives. Customers are urged to verify all transactions directly with the bank or through known contacts before sending funds.

BPI advises keeping OTPs and passwords confidential, avoiding suspicious links, transacting only through official platforms, and reporting any unusual activity immediately.