The Board of Investments (BOI) is recalibrating its strategy in 2026, moving from chasing renewable energy registrations to supporting project execution and targeting high-value sectors.

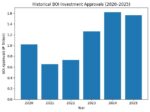

The shift comes after the agency missed its 2025 investment goals, highlighting the need to focus on “realized” projects rather than headline numbers.

BOI Managing Head Ceferino Rodolfo said promotion efforts will now center on mining and mineral processing, digital infrastructure, semiconductors, and electric vehicle (EV) components, while renewable energy (RE) will take a backseat in promotion, emphasizing implementation instead. Offshore wind and other RE projects, he noted, are highly capital-intensive, requiring hands-on support to move from approval to operation.

For mining, the BOI is advocating fiscal reforms and streamlined permitting, positioning the Philippines as a global alternative in the non-China critical minerals supply chain.

In semiconductors, workforce development is key to capturing the wave of geopolitical manufacturing diversification.

EV components and assembly are supported by growing domestic demand, infrastructure rollout, and mineral supply.

Data centers, meanwhile, benefit from renewable energy availability and the government’s data localization policy.

Tourism remains in focus, leveraging visa waivers and ongoing infrastructure improvements to attract investors.

Clearly, the pivot reflects a smarter, outcome-oriented approach. By pairing investment promotion with targeted policy reforms, infrastructure readiness, and global market trends, the BOI is aiming for projects that actually get built, not just registered.

The 2026 strategy signals a more disciplined, diversified investment push: fewer “flashy” RE registrations, more strategic wins in sectors where the Philippines can carve a global niche. After a missed target year, the BOI is betting that quality now matters more than quantity.