The Securities and Exchange Commission (SEC) has expanded the types of corporate amendments that can be processed faster and with fewer requirements, a move aimed at making it easier for companies to do business and comply with regulations.

Under Memorandum Circular No. 3, Series of 2026, the SEC widened the coverage of its online system, eAMEND, allowing more changes to a company’s articles of incorporation and bylaws to qualify for “simple processing.” This means fewer documents, shorter waiting times, and clearer rules for applicants.

One key change allows corporations to submit an affidavit of undertaking instead of a monitoring clearance for certain transactions. The SEC also introduced graduated penalties for late or missing documents, replacing a one-size-fits-all approach. These measures are intended to reduce delays while still ensuring compliance.

The guidelines also seek to shorten processing times even beyond what is required under the Ease of Doing Business and Efficient Government Service Delivery Act of 2018, by using digital tools, standardized forms, and clearer classification of transactions.

SEC Chair Francis E. Lim said the reforms are meant to remove regulatory bottlenecks so companies can focus on growing their businesses rather than dealing with lengthy procedures.

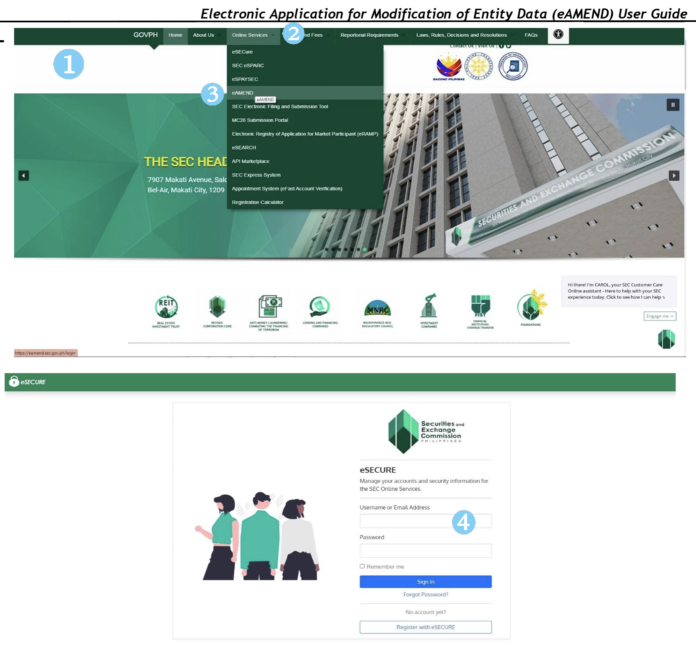

Launched in 2024, eAMEND allows corporations to file amendment applications online. Applications are classified either as simple processing or regular processing. Those under simple processing can receive a digital certificate immediately after system approval, while those under regular processing require further review by the SEC.

Simple processing transactions, which must be completed within seven working days, now cover 28 types of amendments—up from only four previously. Newly included changes cover corporate name, business purposes, term of existence, audit of books, dividends, and the term of office of officers, among others.

Regular processing applies to more complex or technical transactions, such as adopting new bylaws, major bylaw revisions, corporate conversions, and dissolutions. These are given up to 21 working days under the law.

By expanding simple processing, the SEC aims to speed up routine corporate changes, lower compliance costs, and improve the overall ease of doing business in the country.