The Philippines staged a strong comeback in equity capital markets in 2025, powered by the blockbuster initial public offering of Maynilad Water Services, Inc., which ranked as the third-largest IPO in Southeast Asia, according to Deloitte’s Southeast Asia IPO Capital Market Report 2025.

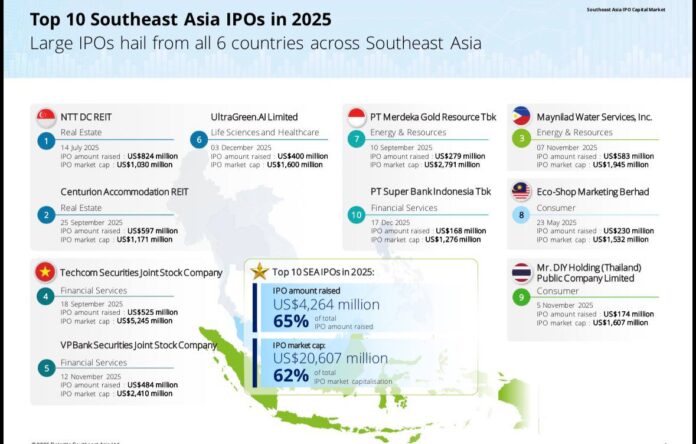

Maynilad raised USD584 million in its November 7, 2025 listing, giving the water utility an IPO market capitalization of USD1.945 billion. The deal trailed only two Singapore offerings: NTT DC REIT, which raised USD824 million, and Centurion Accommodation, which secured USD597 million. Maynilad’s listing stood out as the sole Philippine entry among the region’s largest IPOs.

Deloitte said the Philippine IPO market rebounded sharply despite hosting only two listings in 2025. Total funds raised surged 194 percent year on year to USD596 million from US$203 million in 2024, while total IPO market capitalization more than doubled to USD2 billion from USD972 million. The rebound was largely attributed to a single Energy & Resources sector deal—led by Maynilad.

Across Southeast Asia, IPO activity remained selective but larger in scale. The region recorded 120 IPOs in 2025, raising USD6.5 billion and generating USD33.3 billion in market capitalization. Compared with 2024, total funds raised climbed 76 percent and market capitalization rose 74 percent, even as the number of listings declined.

Hwee Ling Tay, Deloitte Southeast Asia’s capital markets services leader, said the average IPO deal size doubled to US$54 million, supported by several large offerings. Four IPOs raised more than USD500 million, while 14 debuted with market capitalizations above USD1 billion.

While Singapore led in funds raised and Indonesia and Vietnam topped market capitalization, Deloitte noted that the Philippines stood out for quality over quantity—anchored by Maynilad’s landmark listing, which helped reignite investor confidence in the local IPO market.