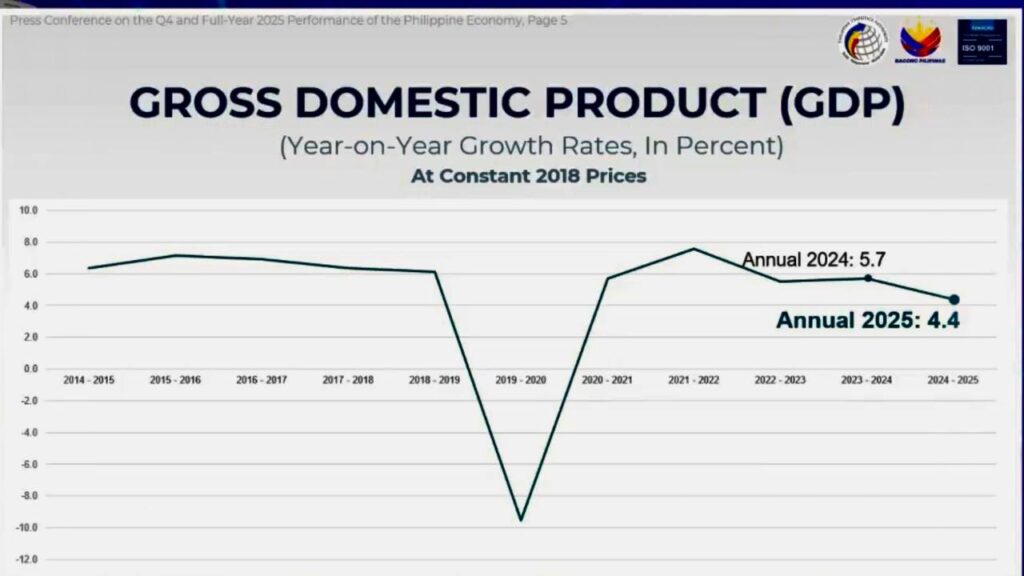

The Philippine economy ended 2025 on a softer note, with gross domestic product growing 3.0 percent year on year in the fourth quarter, bringing full-year growth to 4.4 percent, according to data from the Philippine Statistics Authority. The figures point to an economy that is still expanding—but unevenly, with clear winners and laggards.

Economic Planning Secretary Arsenio Balisacan said disruptions caused by bad weather and the adverse impact on business and consumer confidence of the flood-control controversies, along with global headwinds, have undermined fourth quarter growth that was slowest since the COVID-19 pandemic, when the GDP contracted 3.8 percent in the first quarter of 2021. Full year growth was also down from 5.7 percent in 2024.

“Admittedly, the flood-control corruption scandal also weighed on business and consumer confidence,” said Balisacan. “As a result, domestic demand growth slowed to 0.7 percent in the fourth quarter, bringing full-year growth to 3.7 percent, down from 5.8 percent in 2024. Public and private construction as well as private consumption were particularly affected during this period.”

Growth in the fourth quarter was carried largely by services. Wholesale and retail trade grew 4.6 percent, translating to steadier jobs for sales clerks, logistics workers, and small merchants. Financial and insurance activities expanded 5.6 percent, reflecting robust lending and transaction activity that benefits banks, fintech firms, and consumers with access to credit. Public administration and defense rose 7.9 percent, driven by government spending that supports public-sector employment and social services.

For the full year, the same sectors anchored growth, while manufacturing grew a modest 2.5 percent, suggesting factory output and industrial employment remained constrained by weaker investment.

By major sector, services grew 5.2 percent in the fourth quarter, reinforcing the shift toward a consumption-led economy. Agriculture, forestry, and fishing grew just 1.0 percent, a reminder that rural incomes remain vulnerable to weather and cost pressures. Industry contracted 0.9 percent, hitting construction firms, manufacturers, and suppliers that rely on capital spending.

On the demand side, household consumption rose 3.8 percent, helping sustain retailers, transport operators, and food businesses. Exports jumped 13.2 percent, benefiting electronics, BPO-linked services, and export manufacturers. However, gross capital formation fell 10.9 percent, signaling delayed investments—bad news for construction, heavy industry, and job creation.

For the full year, government spending grew 9.1 percent, cushioning growth, while investment declined 2.1 percent, limiting productivity gains.

There was better news for households. Gross national income grew 6.1 percent in 2025, while net income from abroad surged 19.1 percent, underscoring how remittances continue to support consumption, savings, and resilience for millions of Filipino families.

The takeaway: Filipinos are spending, services are thriving, and overseas income remains a lifeline—but without a rebound in investment, faster and more inclusive growth will remain out of reach.