Inflation in the Philippines has a familiar villain. Every few years, prices surge, household budgets snap, and policymakers reach for the same lever that raises interest rates. But new research suggests they may be shadowboxing the wrong enemy.

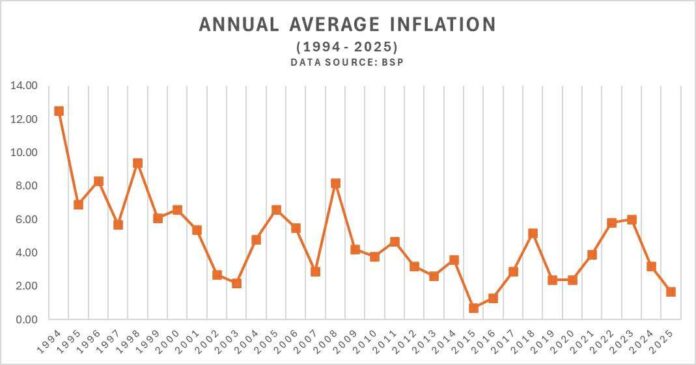

Looking at inflation from 2001 to 2024, economist Jan Carlo B. Punongbayan of the University of the Philippines Diliman separates price pressures into two buckets: demand-side forces like consumer spending and growth, and supply-side shocks like oil spikes, rice shortages, tax hikes, and global disruptions. The verdict is blunt. The country’s biggest inflation blowups—2008, 2018, and 2022—were overwhelmingly supply-driven. (Note: A surge in rice prices in 1994 sent inflation soaring to double digits while deflating rice prices tamed inflation in 2025 to below 2 percent.)

Think oil prices soaring overnight. Think rice supply snarled by policy missteps and weather shocks. Think excise taxes landing just as global prices turn ugly. These episodes pushed prices up not because Filipinos suddenly bought more, but because essentials became scarcer or costlier to produce.

Even more striking: supply-driven inflation reacts harder to external shocks. A jump in global oil prices or a tightening of interest rates abroad sends supply-side inflation spiking faster and higher than demand-driven inflation, which tends to move sluggishly, if at all. That matters because the Bangko Sentral ng Pilipinas’ main weapon—interest rate hikes—works best against overheated demand, not broken supply chains.

The policy implication is uncomfortable but unavoidable. Monetary policy alone can’t fix inflation rooted in logistics failures, food bottlenecks, or energy dependence. Rate hikes may cool spending, but they don’t unclog ports or grow rice.

Punongbayan’s study also stands out for its simplicity. Instead of complex economic models or abstract output gaps, it uses observable price and consumption data—making it practical, transparent, and usable in real time, especially in developing economies.

The takeaway? Inflation in the Philippines is often born outside the central bank’s walls. Taming it requires a whole-of-government response: steadier food and energy supplies, smarter transport systems, and tighter coordination across agencies. Until then, rate hikes alone will keep fighting symptoms—not the disease.