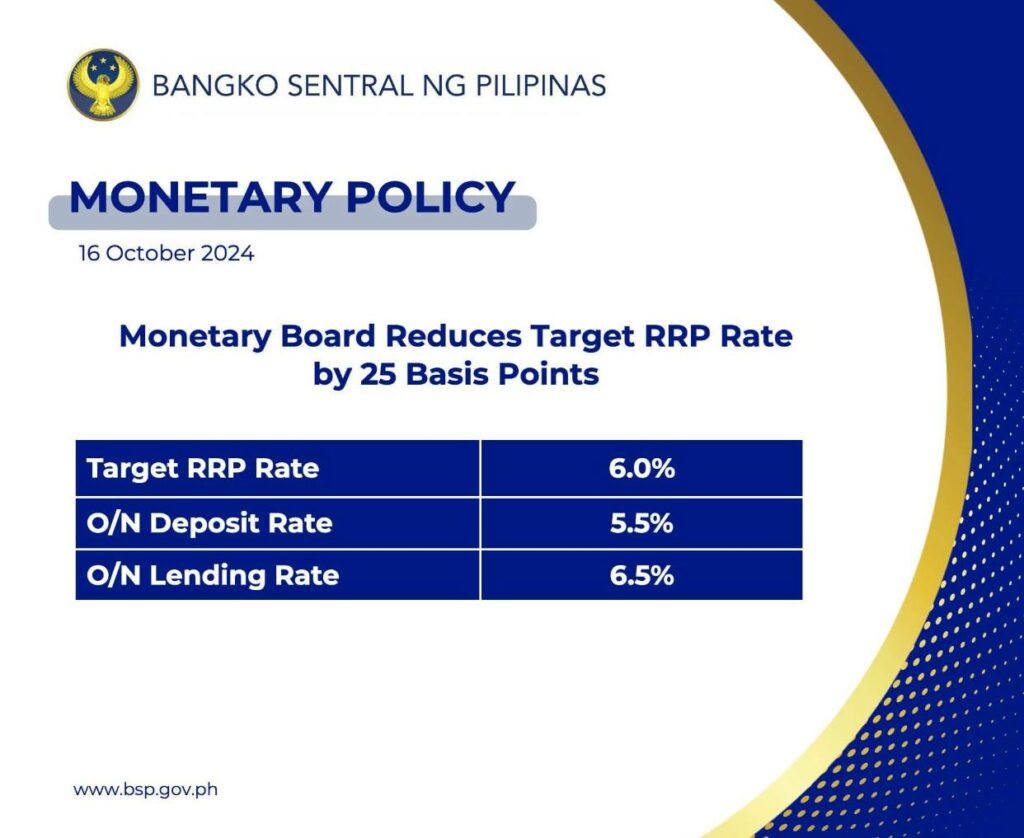

The Bangko Sentral ng Pilipinas (BSP) on Wednesday announced a 25 basis point reduction in its key interest rates, lowering the target reverse repurchase rate to 6 percent. The decision, effective 17 October, follows a similar cut in August and is aimed at stimulating economic activity as inflation pressures ease.

The monetary board’s latest adjustment reflects a significant drop in the annual inflation rate, which fell to 1.9 percent in September—down from 3.3 percent in August and well below the projected 2.5 percent. This marks the lowest inflation rate since May 2020, prompting the BSP to revise its risk-adjusted inflation forecast for 2024 from 3.3 percent to 3.1 percent.

Alongside the interest rate cut, the overnight deposit and lending facilities have been adjusted to 5.50 percent and 6.50 percent, respectively. The BSP’s measures, including a recent reduction in the reserve requirement ratio for banks, are intended to create an environment conducive to economic growth by lowering borrowing costs and enhancing liquidity.

BSP governor Eli Remolona emphasized that the decision underscores the board’s confidence in manageable price pressures and well-anchored inflation expectations. However, the inflation outlook for 2025 and 2026 has been revised upward to 3.3 percent and 3.7 percent, respectively, due to anticipated increases in electricity rates and rising minimum wages in regions outside Metro Manila.

“The balance of risks for inflation remains a concern, particularly with potential geopolitical factors in play,” said the BSP. “Nonetheless, a measured approach to our easing cycle is crucial for ensuring price stability while promoting sustainable economic growth and employment.”

As businesses benefit from lower borrowing costs, the BSP’s continued monetary easing is viewed as a strategic move to support a resilient economy while closely monitoring any emerging inflation risks.