The economy is seen playing catch up in the final three months of the year, its continued growth projected at an average of 5.7 percent at the very least, according to BDO Capital and Investment Corp.

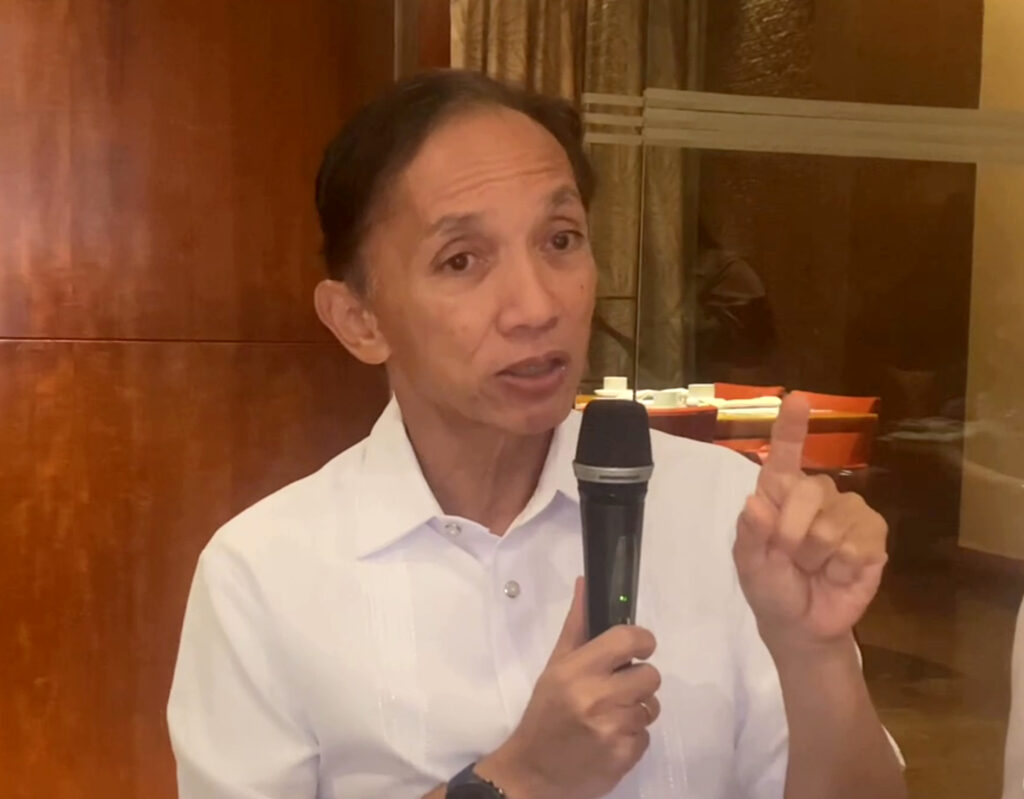

Ed Francisco, BDO Capital president, said the optimism is for growth even higher than 6 percent during the quarter given how the country’s economic planners have managed growth-busting inflation to a 10-month average of only 3.3 percent when weather related disruptions have proven unceasing and traffic congestion, especially in Metro Manila, try very hard to diminish productivity.

“I am optimistic the fourth-quarter growth this year will catch up,” Francisco told the gathered members of Tuesday Club at the Shangri-la EDSA Hotel.

He acknowledged the third quarter expansion outcome of only 5.2 percent versus 6.4 percent a quarter earlier disappointed not just private sector analysts but also even senior level executives in government. This was also why the country’s economic planners have revised the projected growth path lower this year to a range of only 6 percent to 6.5 percent instead of 7 percent previously.

But Francisco argued the USD437-billion Philippine economy has a higher than even chance at expanding 6 percent or more on the basis of the private sector taking up the economic cudgels on behalf of the government. For instance, he said, BDO Capital projects loan growth averaging 13 percent this year, far faster than that tracked by the Bangko Sentral ng Pilipinas (BSP) averaging 10.6 percent in October this year.

“Bank loans have been growing fast, they’re not slowing down,” he said of the aggregate which has a multiplier impact of 1.3 times the country’s output growth, measured as the gross domestic product (GDP).

He brushed off apprehension over the slowing Philippine Stock Exchange index (PSEi) seen hitting 8,000 in 2025 but later recalibrated to 7,700 after President-elect Donald Trump made it back to the White House at the US elections in November. The PSEi is seen rounding 2024 at 7,400.

Francisco said even if the economy is eventually unable to gather enough fourth-quarter momentum of 6.2 percent or 6.4 percent in order to hit the recalibrated 6.5 percent growth target this year, the aspiration should still not be lost entirely. “We still have a fighting chance of making respectable growth because rice prices and inflation are so well managed and even the price of imported oil is OK,” he said.

Regular milled, locally produced rice retails from P43 to P50 a kilo at the moment while imported rice sells from P46 to P50 a kilo, based on Department of Agriculture monitoring. As for fuel, gasoline retails P10.45 per liter higher from year to date, diesel by P9.75 per liter but lower by P1.50 per liter for kerosene, based on data from the Department of Energy.

“The key here is that the real economy is growing well,” Francisco said.