The Philippine Statistics Authority (PSA) has integrated its National ID authentication services with the Small Business Corporation’s (SBCorp) mobile application for loan applications of Micro, Small, and Medium Enterprises (MSMEs).

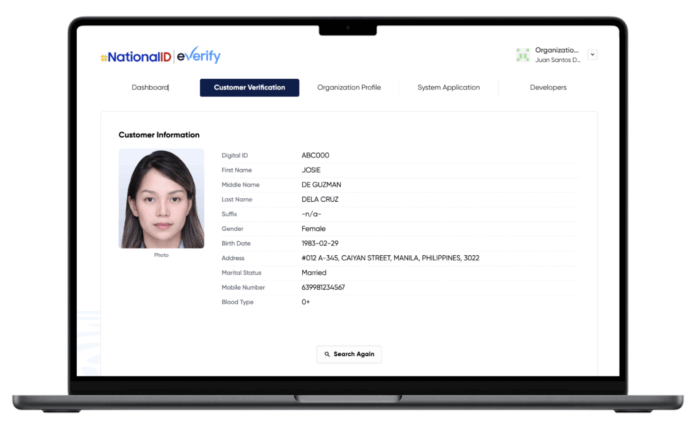

The integration, recently formalized at the PSA headquarters in Quezon City, allows SBCorp to verify the identities of MSME representatives in real time through its mobile platform. This is expected to streamline and secure the loan application process.

A demonstration of the app’s new features included a liveness check or real-time facial recognition during account creation and loan application, enhancing security and ensuring accurate identity verification.

“The National ID system is always envisioned as a digitalization-enabling platform,” said PSA Officer-in-Charge and Deputy National Statistician Minerva Eloisa P. Esquivias, speaking on behalf of Usec. Dennis Mapa. “This integration helps accelerate loan processing and reduces the risk of fraudulent applications.”

SBCorp President and CEO Robert Bastillo emphasized the value of the partnership in improving loan targeting and ensuring that only legitimate applicants benefit. “In the bigger scheme of things, [this partnership] demonstrates the government’s push for integration and coordination. It also gives us a means to clearly identify our clients and reduce identity theft and fraud,” he said.

SBCorp, an attached agency of the Department of Trade and Industry, was established in 1991. Its SBCorp Money app supports MSME development through accessible business financing.

Agencies interested in onboarding may contact the PSA or visit http://everify.gov.ph (http://everify.gov.ph/).