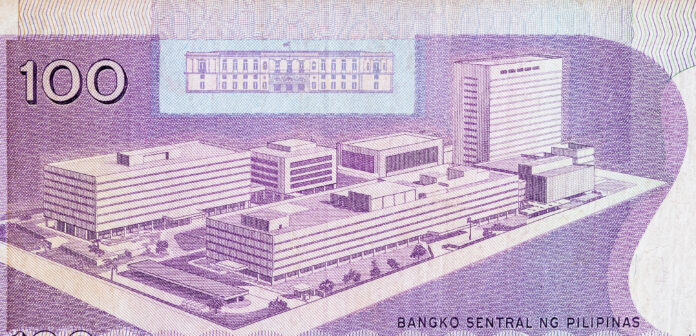

The Bangko Sentral ng Pilipinas (BSP) launched the Open Finance for PERA Pilot at its headquarters in Manila, aiming to make the Personal Equity and Retirement Account (PERA) more accessible to Filipinos through digital platforms.

The initiative utilizes the BSP’s Open Finance framework, which enables secure, consent-based sharing of customer financial data across institutions. This streamlines the PERA account opening process by allowing users to authorize the use of their bank or e-wallet KYC data, eliminating the need for physical forms and ID checks.

Established under Republic Act No. 9505, PERA offers tax incentives to encourage retirement savings, supplementing existing government programs such as the SSS and GSIS.

“This is more than innovation; this is financial health,” said BSP Governor Eli M. Remolona, Jr., emphasizing that integrating PERA with Open Finance will create a seamless digital savings ecosystem.

The pilot involves major financial institutions including Land Bank, Maya, Metrobank, PNB, RCBC, UnionBank, and G-Xchange, with PERA administrators ATRAM, BDO, and BPI Wealth managing investments. Soon, users will be able to open PERA accounts directly through participating apps.

The launch was attended by BSP officials, Monetary Board Members, and key industry leaders, signaling strong support for digital innovation in financial inclusion and retirement planning.