Most banks plan to keep their lending rules unchanged in the first quarter of 2026, according to the Bangko Sentral ng Pilipinas’ latest Senior Bank Loan Officers’ Survey. This suggests banks remain cautious, but not significantly more restrictive, as the economy moves into 2026.

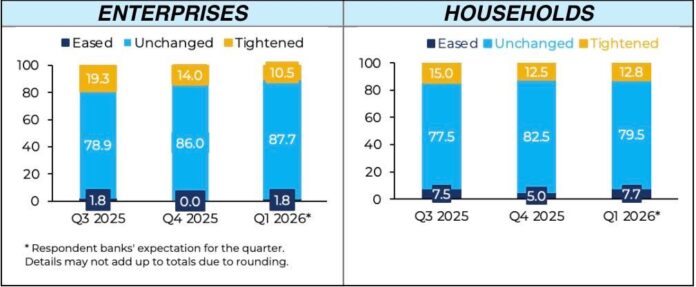

For business loans, 87.7 percent of banks said they will keep credit standards the same in Q1 2026, slightly higher than 86 percent in the previous quarter. Only a small share expects changes, with more banks leaning toward tightening rather than easing. However, the net tightening has eased to 8.8 percent, down from 14 percent in Q4 2025—showing that pressures to restrict lending are moderating.

For household loans, 79.5 percent of banks expect to maintain their standards, slightly lower than 82.5 percent in the previous quarter. Similar to business lending, more banks still expect tightening than easing, but the net tightening dropped to 5.1 percent from 7.5 percent, indicating a softer stance compared with late 2025.

On the demand side, banks are seeing signs of improvement. Fewer banks expect business loan demand to stay flat, while more now anticipate an increase. The share of banks expecting higher business loan demand rose to 28.1 percent from 14.0 percent in the previous quarter. Expectations of declining demand also eased.

A similar trend is seen for household loans, where fewer banks expect demand to remain unchanged and more see demand picking up compared with Q4 2025.

Overall, the survey suggests that while banks are largely holding the line on lending standards, concerns about tightening are easing and loan demand is gradually strengthening—an encouraging sign for economic activity in early 2026.