Metro Manila’s commute has always been a masterclass in controlled chaos. The lines move—until they don’t. The cards beep—until they won’t. And nothing tests patience quite like discovering you’re out of balance just as the train doors threaten to close.

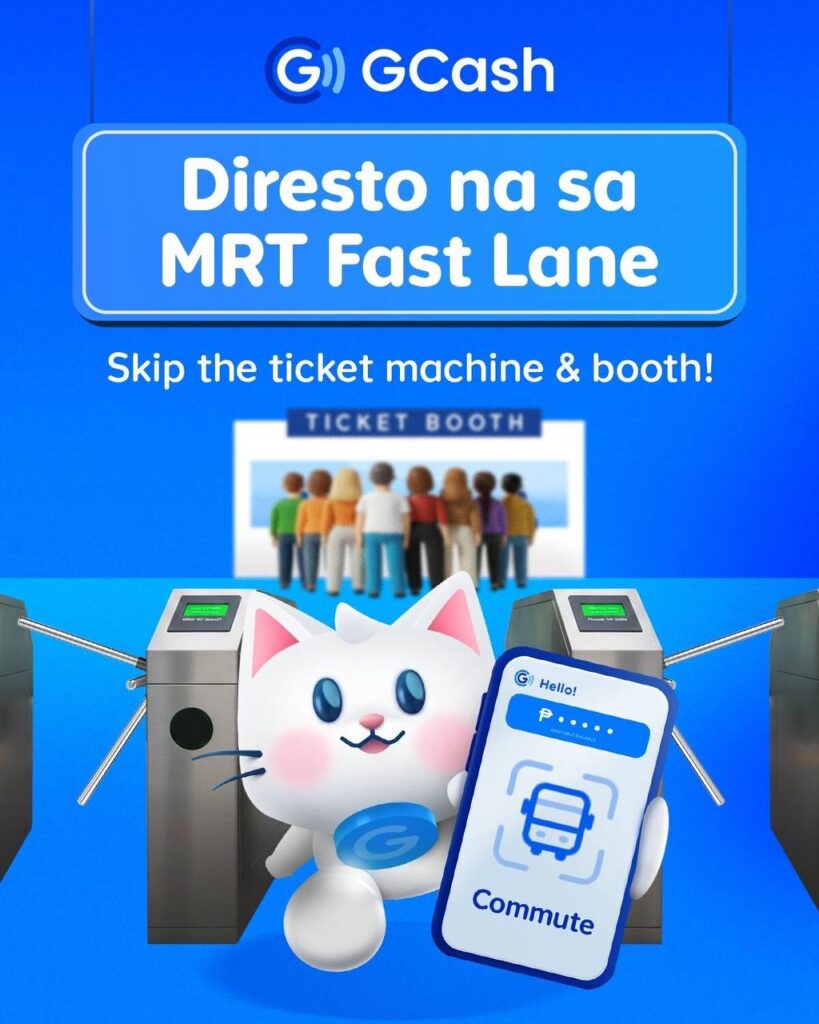

Into that daily pressure cooker steps GCash, which is deepening its integration with MRT-3 to turn smartphones—and even debit-style cards—into train tickets. It’s a practical shift with strategic undertones: make the morning commute faster, and you become indispensable before 9 a.m.

Through the GCash app, riders with NFC-enabled Android phones can activate Tap to Pay and use their device to enter and exit turnstiles, with fares deducted automatically. No NFC?

A generated Commute QR code performs the same function—scan in, scan out, no station input required. Meanwhile, the GCash Visa Card offers a familiar tap-and-go option linked directly to a user’s wallet, doubling as a payment tool beyond the rails.

Free cash-in machines across MRT-3 stations and on-site Wi-Fi support round out the ecosystem, ensuring that topping up doesn’t undo the time saved.

The business logic is straightforward. Transport is a high-frequency, high-visibility touchpoint. By embedding itself into a daily essential, GCash moves from being a transactional app to a habitual utility. Each tap at a turnstile reinforces brand stickiness in a way no billboard can.

The value proposition is simpler for commuters: fewer lines, fewer delays, fewer minor meltdowns before coffee. The MRT-3 isn’t just a rail line for fintech players, it’s prime real estate in the battle for everyday relevance.

In rush hour economics, seconds are currency. GCash is betting that saving them pays dividends.