GoTyme Bank on Wednesday joined hands with the Bangko Sentral ng Pilipinas in allowing its customers to deposit their coins and turn them into high-interest savings.

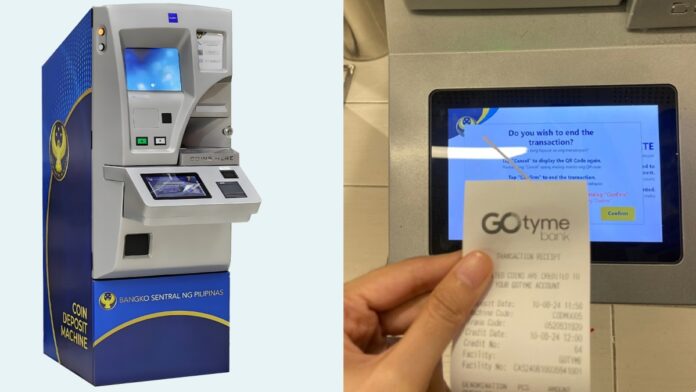

The digital lender has linked its services to the BSP’s coin deposit program, the first such partner to be integrated into the coin deposit machines or CoDMs.

The machines provide instructions on how to deposit client coins into their GoTyme account.

The BSP launched the project in June last year to address in part the coin shortage in certain parts of the country that it believes is artificial.

Apart from promoting coin recirculation, it was also a public service that allowed customers to exchange coins sitting at home into e-wallet credits, shopping vouchers and now, bank deposits.

The service is especially useful for individuals who do not like carrying coins or those who don’t have time to go to the bank to convert them, the bank said.

It offers the unique advantage of being able to convert coins into direct deposits that will earn 4 percent annual interest—60 times more than the average payroll account—and certainly more than if they were merely sitting in a piggy bank at home.

Robinsons Retail Holdings Inc. president and CEO Robina Gokongwei is a huge supporter of the BSP’s CoDM initiative.

She said the program helps support economic activity and restores balance in the monetary system. She said the CoDMs can be found in select Robinsons Supermarkets nationwide.

GoTyme Bank, the Gokongwei family’s joint venture with South Africa’s Tyme Group, earlier claimed distinction as the country’s fastest growing bank with five million depositors by the end of the year.

The digital bank claimed adding 250,000 new customers and a seven-fold increase in transactions a month.