Investors are getting a fresh menu of peso bond options as state-owned Landbank of the Philippines and listed property developer Rockwell Land Corp. line up new offerings, tapping demand for predictable income while interest-rate expectations remain finely balanced.

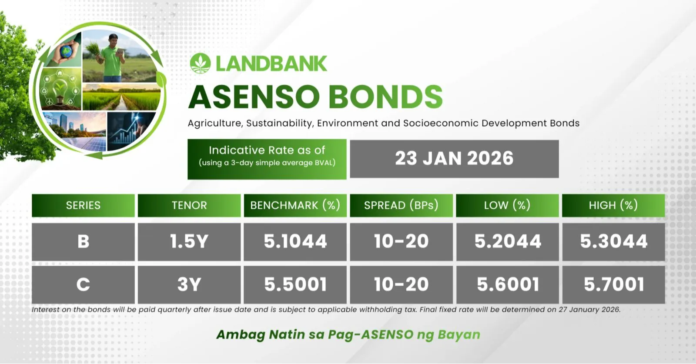

Landbank is offering Asenso Bonds Series B and C with tenors of 1.5 years and three years, respectively. Indicative yields range from 5.2287 percent to 5.3287 percent gross for the 1.5-year paper, and 5.56 percent to 5.66 percent gross for the three-year tranche.

Net of taxes and fees, returns on Asenso Bonds settle around 3.9330 percent to 4.278 percent. With no early redemption feature, these bonds are positioned for investors prioritizing certainty over flexibility. Reservations close January 26, with funding on February 10 and issuance on February 16.

Rockwell Land, meanwhile, brings slightly longer-dated exposure. Its three-year Series A offers 5.71 percent to 6.11 percent gross, while the five-year Series B pays between 6.0274 percent and 6.4274 percent gross, translating to net yields of roughly 4.318 percent to 4.8919 percent. The five-year bonds include an early redemption option on March 18, 2029 at 102 percent, adding a layer of optionality for investors navigating future rate shifts.

Reservations for Rockwell Land run until February 26, ahead of March 16 funding and March 18 issuance.

From an allocation standpoint, the contrast is clear: Landbank appeals to conservative buyers seeking short-to-medium tenor stability, while Rockwell Land offers higher yields and duration for those willing to lock in longer. With minimum orders set at P1 million, these deals target institutional and high-net-worth portfolios fine-tuning income strategies in 2026.

Against persistent inflation uncertainty and gradual policy easing, timing allocations across maturities may help investors balance reinvestment risk, liquidity needs, and return enhancement without overcommitting capital in a volatile rate environment cycle.