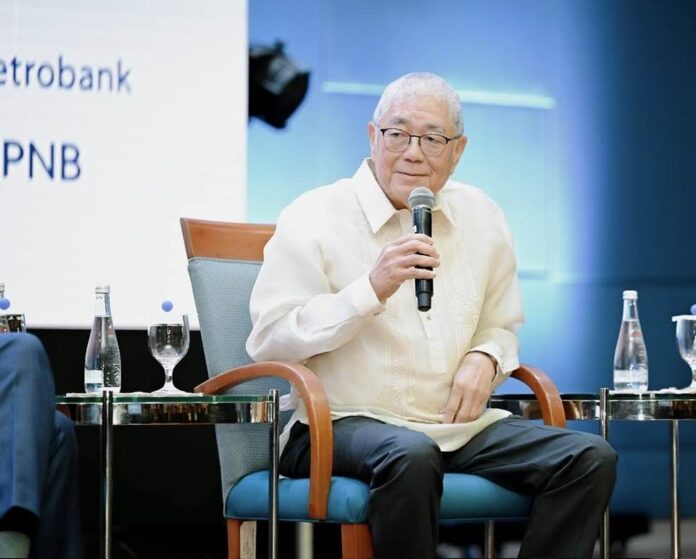

The money market in the Philippines where banks and financial institutions go for their short-term funding requirements has practically disappeared, according to the main man at the central bank, Bangko Sentral ng Pilipinas governor Eli Remolona Jr.

In a recent briefing, Remolona acknowledged the BSP may have spoiled the banks too much for their own good, saying “I think we’ve been spoiling the banks by helping them manage their liquidity (requirements) too much.”

He would also later say: “We do not have a money market. It has disappeared.”

Other banking systems, such as those in Thailand or the United States, have functioning money markets that allow banks and other entities to manage their immediate funding needs.

According to Remolona, this may be because the BSP is simply the money market for the banks and that this is something the monetary authorities are closely looking at.

He hinted that the BSP may increase the incentive for the banks to trade more among themselves in the money market rather than with the BSP.

He offered no particular mechanism or structure making it more compelling for the banks to trade with each other but noted that the BSP introduced the GMRA or the Global Master Repurchase Agreement in the 1990s with this in mind.

The GMRA, former banker Arnulfo “Wick” Veloso told Context.ph, said is an internationally recognized standard contract used in the repurchase market. It was developed by the International Capital Market Association (ICMA) to provide a uniform legal framework for repos across jurisdictions.

The GMRA minimizes credit and operational risks in the repo market and ensures these are treated consistently as secured financing transactions rather than outright sales, Veloso explained.

Remolona said the banks have not been using the GMRA as much as they should, although the industry has agreed more recently with them to revisit the instrument and use them more down the line.

“We hope it will develop the repo market,” he said.