The Philippine office market is poised for gradual recovery in 2026, following a stronger-than-expected performance in 2025, according to Colliers Philippines.

Kevin Jara, director and head of tenant representation at Colliers, said the sector is returning to pre-POGO market behavior, with transaction volumes and supply levels now resembling those recorded between 2014 and 2016.

“The office sector continued its strong showing for all of 2025 despite major disruptions in 2024, including the POGO ban and the US elections,” Jara said. “We’re seeing a return to pre-POGO trends, which is a positive signal for the market.”

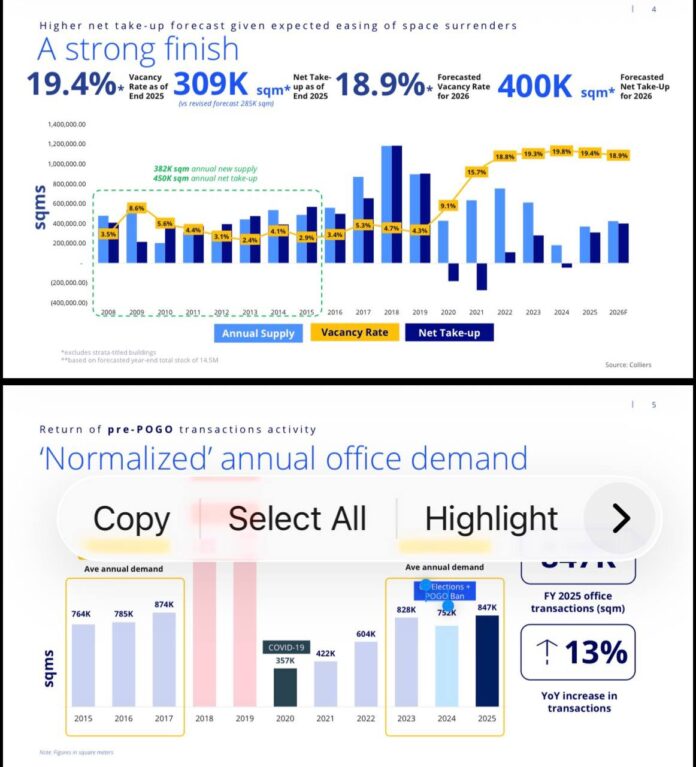

Metro Manila ended 2025 with a vacancy rate of 19.4 percent, down from 19.8 percent in 2024, while net take-up reached 309,000 square meters, surpassing Colliers’ initial forecast of 285,000 square meters.

Jara noted that to meaningfully reduce vacancy rates by around two percentage points, the market would need at least 600,000 square meters of net take-up—a level achievable even without POGOs.

Colliers expects net take-up of 400,000 square meters in 2026, forecasting gradual improvement in vacancy rates. The firm highlighted growing demand from shared services firms, global capability centers, and traditional office tenants as key drivers.

Despite optimism, Jara cautioned that no industry has matched the disruptive impact POGOs once had. Still, with a post-pandemic high of 847,002 square meters in office transactions recorded, the market’s resilience is clear.

As the office sector steadies itself, Colliers remains cautiously bullish on steady absorption, moderate supply additions, and a return to stable pre-POGO dynamics over the next five years.