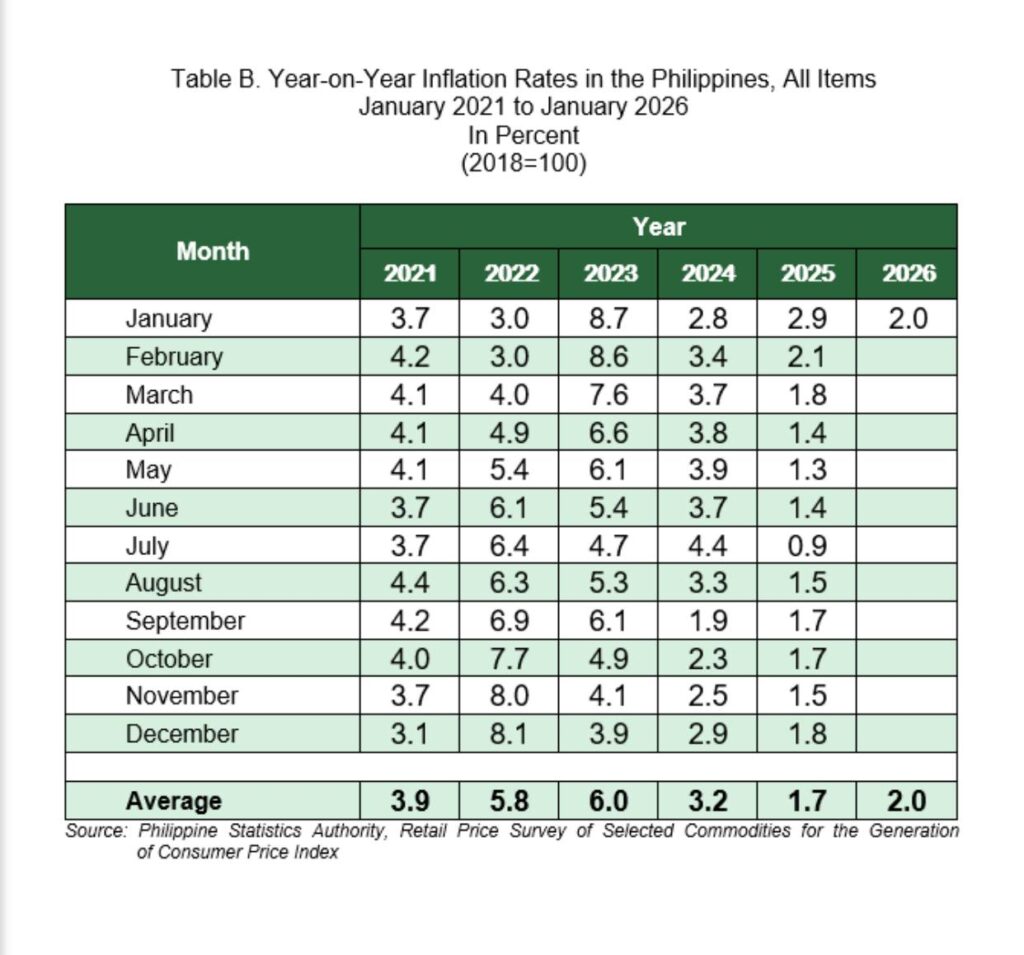

Headline inflation in the Philippines nudged higher to 2.0 percent in January, a gentle but telling start to the year. The uptick is modest but the fastest clip since January last year when the consumer price index, the country’s main inflation barometer, showed a 2.9 percent print.

The mix of price pressures offers a clearer read on where Filipino wallets are feeling the squeeze.

The biggest push came from housing, water, electricity, gas and other fuels, where inflation accelerated to 3.3 percent from 2.5 percent a month earlier. Utilities rarely shout, but they always show up on the bill—and this time they did so loudly enough to account for a third of January’s overall inflation.

Restaurants and accommodation services followed suit, with inflation jumping to 4.0 percent from 2.4 percent, a reminder that eating out and travel are getting pricier again.

Other categories quietly joined the climb. Clothing and footwear, furnishings, health, information and communication, recreation, and personal care all posted faster annual increases, suggesting price pressures are broadening beyond a few usual suspects.

Still, not everything moved up.

Food and non-alcoholic beverages cooled to 1.1 percent inflation from 1.4 percent, while food inflation overall eased to just 0.7 percent—far below the 4.0 percent recorded a year earlier.

Alcohol and tobacco, education services, and transport also softened, with transport slipping into a 0.3 percent annual decline as fuel-related pressures waned.

Under the hood, core inflation climbed to 2.8 percent from 2.4 percent, signaling firmer underlying demand. The takeaway: inflation isn’t running hot, but it’s no longer on cruise control either.

Higher core inflation could undermine hopes that the Bangko Sentral ng Pilipinas will deliver another interest rate cut later this month.

For the bottom 30 percent income household, inflation in January stood at 1.6 percent, up from 1.1 percent in December but lower than the 2.4 percent recorded a year. Higher food and housing costs intensified inflation pressure on the poor.

Economic Planning Undersecretary and National Statistician Claire Dennis Mapa acknowledged that aside from consumer price risks, the lower statistical base last year will have an impact on inflation trajectory for the rest of the year.